Infrastructure & Construction Equipment Industry in India

Mr. Rajesh Nath, Managing Director, VDMA India

Mr. Ajmal Fawad, Business Analyst, VDMA India

Introduction

A well-developed infrastructure is a foundation for growth in any country, paving the way for a better quality of life and a rapid rise in gross domestic product (GDP), especially for developing countries such as India.Construction sector in India is considered to be the second largest employer and contributor to economic activity, after agriculture sector. Construction sector also accounts for most inflow of Foreign Direct Investment (FDI) after the services sector and employs more than 35 million people in the country. 50% of the demand for construction activities in India comes from the Infrastructure sector, while the rest comes from Industrial activities, residential and commercial development etc. Indian Construction Industry value is estimated to be more than $126 billion.

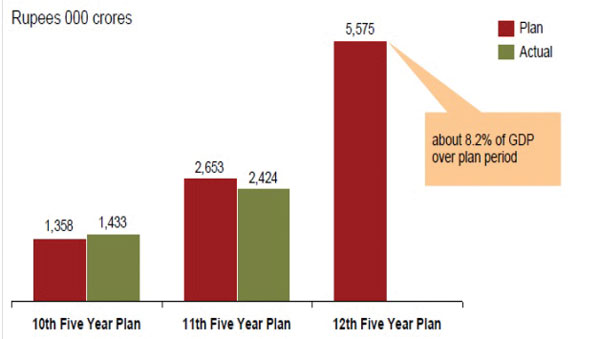

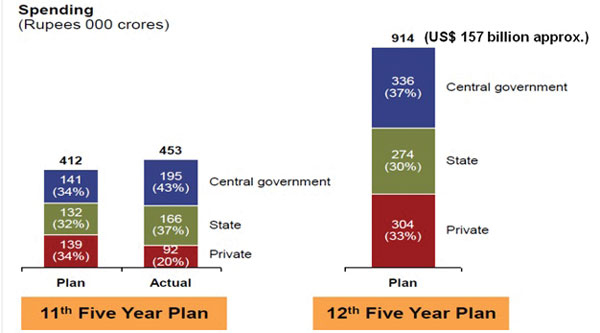

$1 trillion earmarked for investment in the 12th Five Year Plan

Infrastructure growth holds the key to the industry realizing its potential in India. In the 12th Five Year Plan, the government has earmarked approximately $1 trillion for infrastructure investment, with 40% of the funds to come from the private sector. In order to attract such investment, the Indian government has eased FDI norms for quite a few sectors of infrastructure development. This is likely to spur the demand for the earthmoving and construction equipment, and if the industry's full potential is realized, the result could be a $16 billion to $21 billion industry by 2020.

The 12th Five Year Plan

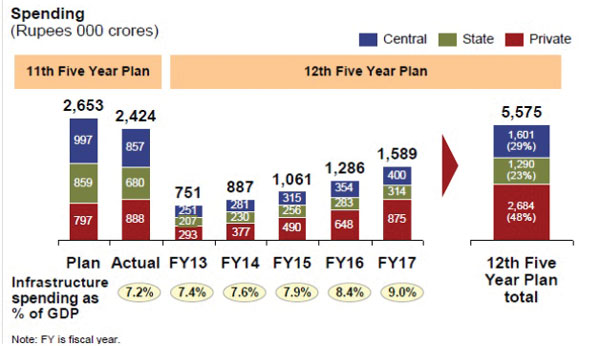

India's need for infrastructure development is also well supported by the government's intentions as outlined in the 12 Five Year Plan (FYP). Infrastructure is one of the plan's primary areas for spending, with about $1 trillion (Rs.55 lakh crores) earmarked for investment. Five sectors account for more than 80% of total planned spending: electricity, telecom, roads and bridges, irrigation, and railways, including mass rapid transit systems.

Investments in Indian roads are expected to jump

Overall, infrastructure spending is expected to grow from 7.2% of GDP in the 11th FYP to 9% by fiscal year 2017. Private investment in infrastructure is expected to increase from Rs.8.8 lakh crores in the 11th FYP to Rs.26.8 lakh crores in the 12th FYP, with the last year alone of the 12th FYP period (fiscal year 2017) attracting private investment of Rs.8.7 lakh crores. More than 80% of private-sector spending will continue to focus on four sectors: telecom, electricity, roads & bridges, and renewable energy. Private investment in infrastructure is expected to increase from 37% in the 11th FYP to 48% in the 12th FYP. This growth is expected to be spurred by private players' expected capacity expansion and their ability to provide good quality, timely service while keeping costs low.

Indian Urban Infrastructure

Over the next 20 years, it is estimated that US$ 650 billion investment is required in urban infrastructure. Of this, almost 45% is required for development of urban roads.To boost urban infrastructure across the country, the government has initiated numerous measures and has allocated almost US$ 2 billion under Jawaharlal Nehru National Urban Renewal Mission (JNNURM). The government has also launched the Urban Infrastructure Development Scheme for Small and Medium Towns with an outlay of US$ 1 billion to address infrastructure needs of small towns and cities.

Additionally, there is a renewed push towards Public Private Partnerships (PPP) in the sector. Delhi - Mumbai Industrial Corridor (DMIC) is an ambitious Infrastructure programme conceptualized with Japanese government and aiming at developing new industrial cities as "Smart Cities" and converging next generation technologies across infrastructure sectors. Projects worth investment of US$ 200 Billion have already been approved under DMIC. Success of DMIC has prompted many similar corridors including Bangalore Chennai corridor etc.

Roads

India has one of the largest road networks in the world, behind only the United States and China. And to improve the country's road infrastructure, the Indian Government estimates that over US$ 27 billion private investment is required during the 12th FYP (FY12-17).So far under NHDP (which started in early 2000s), 33,500 kms are developed or are under the implementation phase with balance 21,000 kms are yet to be awarded. Extensive contribution of the private sector is being utilized for implementation of NHDP through contracting and Public Private Partnership (PPP).

The 12th FYP outlays an increase in planned investments by more than 100% from the 11th FYP achievements, driven by higher targets across national highways, state highways and rural roads. The FYP has plans for about 13,000 kilometers of new national highways and 1,58,000 kilometers of new roads in rural areas. Apart from government spending, private funding has increased from 5 percent in the 10th FYP to 20% in the 11th FYP, primarily driven by factors such as 100% foreign direct investment in road infrastructure, 10- to 20-year tax breaks during concession periods and duty exemptions for importing road equipment. The ongoing 12th FYP targets about 33% of the investment to be fulfilled by the private sector. So far, 3928 kms of National Highways and 39,144 kms of Rural Roads, have been created till December 2013 to give a big boost to infrastructure industries.

Investments in Indian roads are expected to jump

The value of total roads and bridges infrastructure in India is anticipated to grow at a CAGR of 17.4% over FY12-17. The country's roads and bridges infrastructure, which was valued at US$ 6.9 billion in 2009, is projected to touch US$ 19.2 billion by 2017.

Airports

There are a total of 454 airports in India, out of which around 90 are open for commercial services and 16 are designated as international airports. Delhi and Mumbai are by far the busiest airports in India, carrying almost 2.5 times traffic as the next busiest airport.The growth so achieved has put tremendous pressure on current airport infrastructure in the country. The Indian Government has projected that an investment of around US$ 12 billion in the next five year plan will be needed to help cope with additional demand, and private sector participation is expected to play a key role. 75% of the investment envisaged in the next five year plan is expected to be contributed by private sector.

Railways

Railways have continued to be another large focus area for developing transportation infrastructure. The Government has earmarked about Rs.5,19,000 crores for railways during the 12th FYP, of which about Rs.95,000 crores are targeted for investment in dedicated freight corridors on eastern and western routes. In the current five year plan, 3,343 kms of New Railway track have been created till December 2013 to give a big boost to infrastructure industries.One major programme intended to attract private investment is the Dedicated Freight Corridor project. The project is intended to decongest the routes between Delhi & Mumbai and Delhi & Kolkata by building dedicated cargo lines at an estimated cost of US$ 6–7 billion.

Ports

For ports, the 12th FYP budgets investment worth Rs.1,98,000 crores, of which around 85% is expected to be fulfilled by private players. Till December 2013, 217.5 milliion tonnes of capacity per annum in our ports have been created to give a big boost to infrastructure industries. The capacity of ports in India by the end of the 12th Five-Year Plan is targeted to touch 2,493.10 million tonnes per annum (MTPA) as against 1,245.30 MTPA at the end of the 11th Five-Year Plan (2007-12).Indian Earthmoving & Construction Equipment Industry

Investments in infrastructure are the main growth drivers of the construction equipment industry. The Planning Commission estimates total infrastructure spending to be about 10% of gross domestic product (GDP) during the 12th Five-Year Plan (2012–17), up from 7.6% during the previous plan (2007–12).

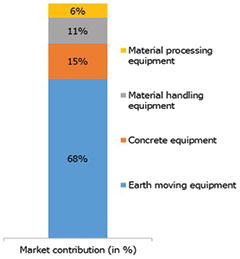

Construction equipment market share by segment

In FY12, backhoe loaders is estimated to comprise over 50% of the earthmoving equipment sales based on units, followed by crawlers (about 23%). Clawer excavators is expected to be the fastest growing segment, with sales to double to 28,000 units by 2016, mainly on demand for mid-size crawlers (20T) from the construction segment and their versatile usage. Backhoe loaders and crawlers excavators are expected to account for over 70% of total sales by 2016. The share of crawler excavators is estimated to increase to 35% by 2016 from the current 23%, mainly on demand for medium-sized crawlers (20 tonnes) from the construction segment. Demand for larger excavators (30 tonnes) used in the mining segment is also expected to increase in the years to come.

Concrete equipment is the second largest segment with a market share of approximately 14%. It comprises asphalt finishers, transit mixers, concrete pumps and batching plants. Material handling equipment and material processing equipment account for 10% and 6% of the market respectively. Cranes are the largest category within the material handling equipment.

In terms of growth, the global earthmoving equipment market recorded a review period (2008-2012) CAGR of 1.67%. The growth was subdued by a 34.1% decline in the market in 2009, due to the financial crisis. Construction activity slowed and demand for earthmoving equipment declined in 2009, the worst year in the economic crisis. The global earthmoving equipment market is expected to record a forecast period CAGR of 5.59% due to the construction industry growth, infrastructure and residential development in emerging economies, and the easing of the financial crisis in Europe.

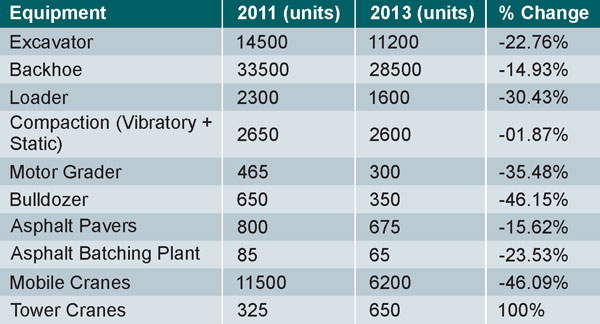

CE market contracted in 2013

The global construction equipment market was estimated at Rs.5,551 billion (US$ 90.5 billion) last year and is expected to reach Rs.7310 billion by 2016, representing CAGR of 7.7%. Emerging markets such as China and India are becoming increasingly important on the global stage as key players shift their production bases to Asia to drive revenue by benefitting from region's growing infrastructure investment, favourable government policies and mass-scale domestic markets.

India's construction equipment market meanwhile, outpaced global growth trends with the market estimated at Rs.208.4 billion at the end of last year.

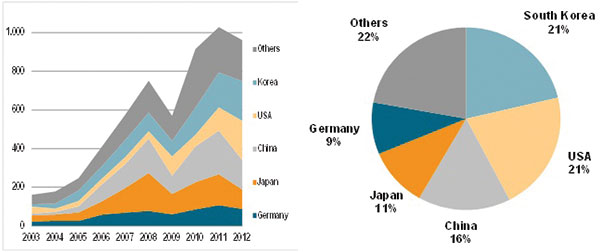

Revenues increased at a CAGR of 6.6% during FY07-12 and are further estimated to rise at a CAGR of 24.8% on rapid infrastructure development undertaken by the Government of India. Out of the total exports of Construction Equipment to India, South Korea and USA take the highest share of 21% each followed by China Japan & Germany 16%, 11% and 9% respectively.

The construction equipment industry's revenues are expected to reach US$ 22.7 billion by 2020 from US$ 5.1 billion in FY 12. Unit sale of construction equipment is expected to grow to 82,000 by 2016 from 61,745 in FY 12.

Exports of Construction Equipment to India

Increasing impetus to develop infrastructure in the country is attracting the major global players. There has been cumulative FDI inflow of $175.0 million in earth- moving machinery between 2000 and 2013. The Government of India has de-licensed the material handling equipment industry and allowed 100 % foreign direct investment (FDI) under the direct route. The government has also given approval to some financial institutions to raise money through tax-free bonds.

Equipment Financing and Renting in India

As with any product that requires a large one-time capital expense, financing is a good way for the construction equipment industry to spark demand and acquire new customers. India's earthmoving and construction equipment (ECE) financing industry was valued at Rs.23,000 crores. Financing accounts for about 80% of the equipment purchased. For imported machinery, it's even higher, with 90% of equipment purchased being financed.Over the next few years, the ECE financing industry is expected to grow by a compound annual growth rate of about 22%. Most financing is through loans, with leasing as a distant second option. About 80% of ECE users that opt to finance are micro, small, and medium-sized enterprises. With ticket sizes varying from Rs.20 lakh for a backhoe loader purchased by an individual user to Rs.20 crores for a construction firm's bulk equipment purchase, the variety of players offering equipment financing has grown. Non Banking Financial Companies handle 75 to 80% of ECE financing.

Penetration of financial intermediaries in the market is high – over 80% of all CE bought in India are financed. Main buyers of non-financed equipment include government and public sector undertakings. These are percentage of capital investment across sectors, but in CE alone the penetration is far higher. The market is dominated by First Time Buyers (FTBs) with 60% of the market share indicates a broad based market with easy access to financing. FTB and Mid segment (small retail buyers) together constitute the retail segment of the market which accounts for a large market.

Construction companies are under a lot of pressure to trim capital outlay and hence they increasingly rent equipment on a monthly or hourly basis, or where possible, on the amount of material handled. Again, the current rental penetration in India at around 7 to 8% remains low as compared to the global standards of 50 to 80%. Leasing/rental of construction equipment is still a very fragmented industry in India, but is expected to show strong growth, possibly higher than 30% annually over the mid- term. Several OEMs have already constituted dedicated teams for the rental/leasing services.

A robust rental market enables reduction in investments in projects by outsourcing the equipment requirement (including spares and services) and improving capacity utilisation of equipment. The key equipment in the rental fleet in India currently are backhoe loaders, pick-n- carry (PNC) cranes, excavators, motor graders, and vibratory compactors. The equipment rental and leasing business in India is smaller compared to Japan, USA and China. Demand for rental equipment is set to witness strong growth in the mid-term due to large investments in infrastructure. New players can also explore opportunities in the equipment finance business.

The limited presence of large organized players is restricting the growth of rental financing. Given the industry's narrow focus today and the tremendous opportunities for growth, better access to financing will help broaden the market.

Key Challenges for Infrastructure and Construction Equipment Industry

Land acquisition delays: Across infrastructure projects, delays as a result of land not being acquired by the time projects are awarded have affected many projects both before and after they start. For example, land clearance issues held up the Trivandrum-TamilNadu border road project, though the tender was awarded in 2010. Country-wide regulations on land acquisition have been enforced in a non-uniform fashion, causing delays. Even lenders are unwilling to support projects unless clearances are available and 100% right of way has been secured.Clearance delays: Delays related to forest and environment clearance are also impacting many infrastructure projects. Clearance policies are often not used objectively, providing different rationale for clearances on different occasions. Not only does this impact the speed of clearances, it also sends uncertain signals to investors—and often leads to pullback of investments. For example, the contractor for the Kishangarh-Udaipur-Ahmedabad six-lane highway has terminated the project because environmental clearance failed to materialize. Similarly, lack of clearance from the state water department held up the Chennai Port-Maduravoyal road project.

In addition to addressing infrastructure challenges, the ECE industry achieving its full potential will hinge on addressing challenges in three areas of the ECE ecosystem:

Financing

- Original equipment manufacturers (OEMs) in India offer limited financing options, and payment terms for first-time users are often unfavorable. The result is that access to financing prevents many prospective users from buying.

- Renting is a good option for users with an eye on limiting their large capital expenditures. However, renting penetration in India is much lower (7 to 8%) than in other large ECE markets (65% in the United States and 35% in China) because of a tax regime that makes moving equipment across states unviable.

- India's secondary market for used equipment is underdeveloped.

- Recovery is a big challenge for non-bank finance companies, the major providers of ECE financing for whom regulations pertaining to defaulters and bad debts are not very favorable.

Unavailability of Skilled Manpower

- As the ECE industry rapidly grows, the need for trained operators and mechanics will increase proportionately. Availability of skilled workers is likely to be an issue. Multiple entities from the government, ECE companies and industry bodies are working to solve the skill gap issue, but coordination among these agencies can be improved.

- Most construction-equipment users are small players who prefer on-the-job training for operators and mechanics and are unwilling to pay a premium for qualified workers.

- Specialized courses on construction equipment operations are not a part of vocational training at industrial training institutes because the high cost of equipment makes hands-on training expensive. ECE training institutes run by OEMs tend to be expensive for low-income groups.

- There is a lack of uniform national guidelines for safety and quality. On-the-ground enforcement is a challenge because of the fragmented nature of the industry. (Small contractors make up about three-fourths of the industry.)

Components

- There is a high variability in OEM demand owing to market fluctuations, which makes capacity planning difficult for component providers.

- India is a market where component suppliers tend to focus on items at the lower end of the technology spectrum, while relying on imports for high-tech items. Consequently, there is a gap in terms of technology adoption at the supplier end, where the market demand for higher connectivity and compliance to fuel economy regulations is not met with indigenously manufactured components.

- Suppliers are also constrained for operating margins because the market is very price and value conscious.

The Road Ahead: India is poised to be world's 3rd largest construction market by 2025

All signs point to a country that would be wise to focus on developing its infrastructure. And when it does, demand for earthmoving and construction equipment (ECE) will surge. Growth in a country's fleet-size ECE stock is highly correlated to the growth of the construction industry (a proxy for infrastructure growth), with a high correlation coefficient (more than 0.99). In the near future in India, the bulk of construction growth is likely to come from growth in transportation infrastructure (roads, rail, airports, ports), urban infrastructure (mass rail transit systems, water supply and sanitation, urban housing) and rural infrastructure (rural roads, irrigation, rural housing)—three important sectors for driving ECE demand. With significant infrastructure investment and growth expected in India, it is expected that ECE stock will exhibit robust growth in the near future.The ECE market is expected to grow by a healthy 20 to 25% over the next few years to reach 3,30,000 to 4,50,000 units sold in 2020, from current levels of about 76,000 units. This would imply a $16 billion to $21 billion market, up from today's $3 billion. The sector will continue to be dominated by backhoe loaders (more than 40% of total demand), but broad-based growth is expected across products, with each segment expected to see double-digit growth. A rise in the use of concrete will also create demand for concrete equipment in infrastructure and housing projects.

Bibliography

- Website of India Brand Equity Foundation (IBEF): www.ibef.org

- Website of Indian Construction Equipment Manufacturers' Association (Icema): www.i-cema.in

- Website of Government of India Planning Commission: www.planningcommission.gov.in

- Website for Indian Union Budget 2014-15: www.indiabudget.nic.in

- VDMA statistics on "Construction Equipment and Building Material Machinery"

- Deloitte report on "Infrastructure & Construction Sector"

- AT Kearney report on "ECE Industry"

- BDB report on "Indian Construction Equipment Sector"

- Specific inputs from Mr. Faridi, Editor, New Building Materials & Construction World

NBM&CW December 2014