Off-Highway Electrified Equipment Market

Alastair Hayfield, Senior Research Director at market research firm Interact Analysis, takes a look at the challenges in electrification of off-highway vehicles, the equipment category that will lead electrification, the market of electrified components and what the future holds in terms of their pricing.

Unlike in the road vehicle sector, there is great diversity of equipment in the off-highway vehicle market - from forklift trucks to heavy-duty dump trucks. Off-highway vehicles don’t form a group of uniform applications, and each vehicle type has a relatively low-customer base compared to road vehicles. This means that it is much more difficult for off-highway OEMs and related component producers to achieve the economies of scale gained by their on-road counterparts, and this is a key factor when considering the issue of electrification of off-road vehicles.

Key considerations

Barriers such as sheer vehicle size and power requirements, charging infrastructure, the wide range and intensity of duty cycles, and the length of down-time for charging, have meant that electrification of off-highway vehicles has seen a slow take-up. Nonetheless, almost every OEM has produced an electrified off-highway vehicle of some description, and the market for electrified componentry is forecast to grow.

But the success of the electrified powertrains market in off-highway vehicles will not only be determined by purchase cost and fuel consumption issues as better performance, controllability and flexibility, and reduced maintenance costs will also be key considerations, as will the environmental advantages.

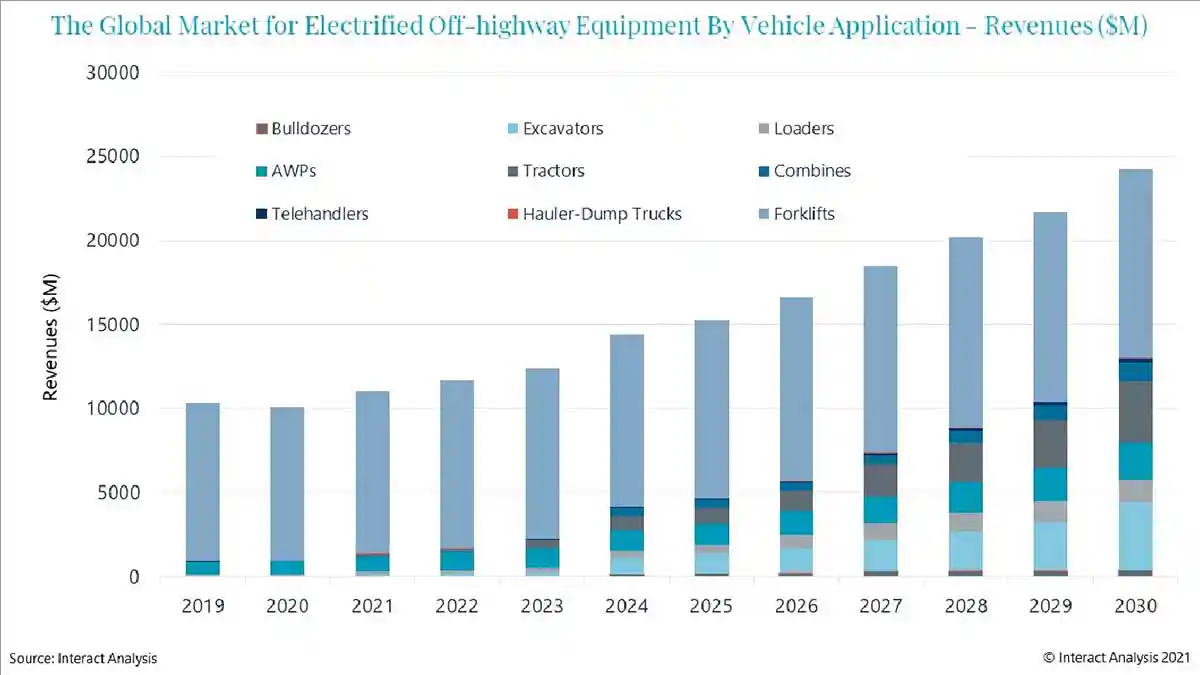

Electrified off-highway components market to be worth $25bn in 2030

Our analysts have found that the global market for electrified components in off-highway vehicles was approximately $10 billion in 2020. We project that this figure will rise to $25 billion by 2030, increasing at a CAGR of 8%, with total revenues between 2019 and 2030 standing at $186 billion.

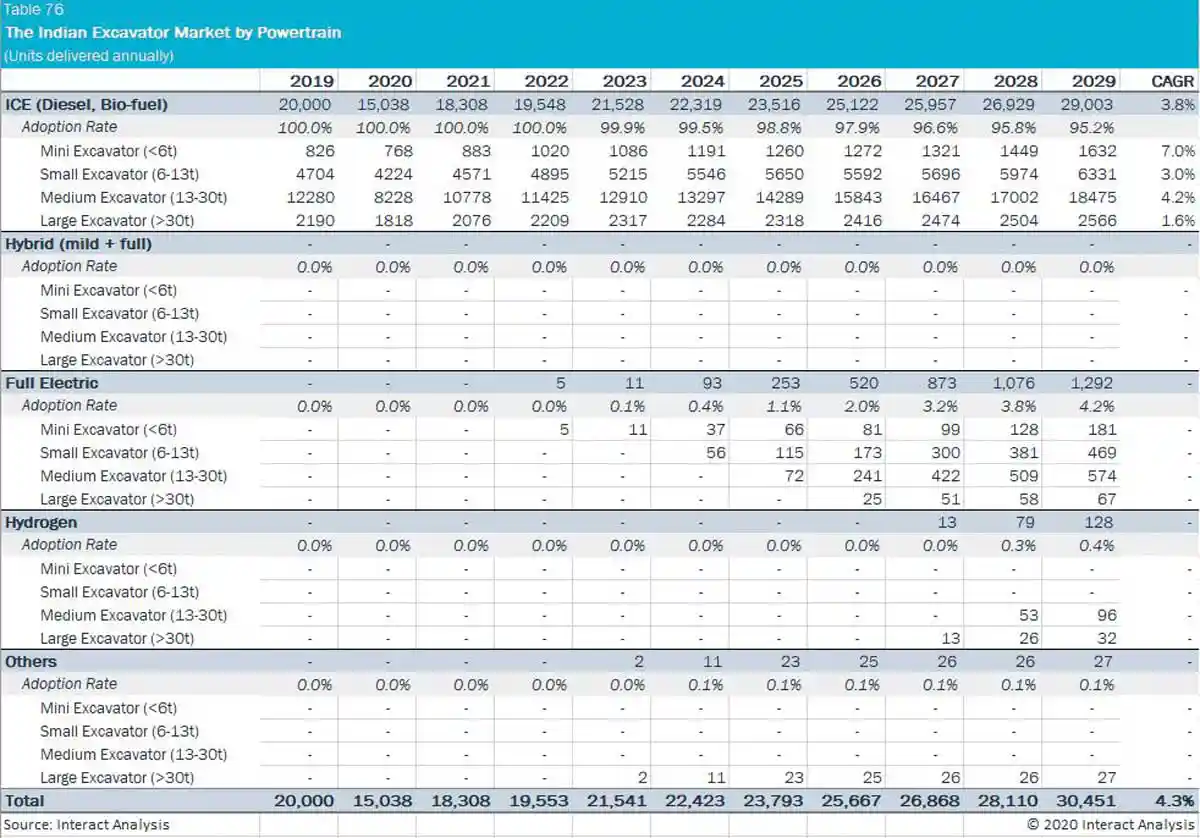

The forklift market, being by far the most mature where electrification is concerned, currently accounts for the great majority of electrified component sales, but this will change as new electrified technologies suited for other applications such as excavators and tractors come on stream.

Given the challenges of electrifying off-highway vehicles, it’s reasonable to ask if it’s actually feasible to electrify all categories of the market. But answering this question is challenging. One particular difficulty for off-highway powertrain engineers is the lack of scale: given the small volumes of some machine categories, and the wide array of duty cycles, it’s tough to build the standardized platforms needed to drive down costs. And for the heaviest applications there’s a serious question of whether batteries can do the job at all. Material handling is certainly the most promising segment, with over one million electric forklifts and aerial work platforms currently sold per year.

Two electro-tech solutions for off-highway: hybridisation and on-board charging

The three electrified component segments forecast to offer the biggest revenue opportunities are battery packs, inverters, and motors. Battery pricing is of major importance to all electrified vehicle markets. The current price per KWh for a battery for an off-highway vehicle stands at $350 to $500 per watt - 2 or 3 times the price of a similar type of battery for a road vehicle. The reasons for this are two-fold: the aforementioned lack of scale in off-road electrified component manufacturing, and the non-standard, specialised packaging and shape of off-highway batteries, particularly in construction and mining equipment.

Reflecting the current trend towards ‘hybridisation’ of off-highway vehicles, where the main powertrain may be traditionally ICE powered, but auxiliary functions are driven by electric power, the work function inverter market is expected to grow more swiftly than the traction inverter market.

We predict that Permanent Magnet Motors will see the highest revenues in the motor sector. Meanwhile, fuel cell technology is likely to see slow penetration into the off-highway market, but the high price of fuel cell systems and hydrogen storage tanks means that actual revenues from this technology could become quite considerable. Fuel cells have attractive advantages, such as high energy content, ensuring high intensity continuous operation and the swift hydrogenation of a vehicle – 1-3 minutes – compared with the much longer charging times for lithium-ion batteries. Much depends on the establishment of infrastructure and the logistics for safe hydrogen transportation.

150% growth by 2030 projected for Off-Highway Electrified Components Market

The lack of availability of high-power charging infrastructure means that, as the use of high voltage components increases, the market for on-board chargers is also likely to grow. And it is anticipated that on-board charging technology will become widespread in the off-highway vehicle sector. The global market for on-board chargers was around $1 billion in 2019. We forecast that it will expand to 2.5 times by 2030. This is due to a unique issue that the electrified off-highway market will face – there will be no off-board charging options in most real-world scenarios. On-board chargers are therefore likely to be a point of competition between manufacturers.

Will Automotive help Off-Highway slash the price of Electrified Components?

The pricing of powertrain components is key to the success of the electrified off-highway vehicle market. But getting the cost of powertrains down to a competitive level with their internal combustion engine equivalents is a significant challenge.

Internal combustion off-highway machinery has been around for a long time and drivetrain component pricing is highly competitive. In comparison, the electrified off-highway vehicle is the new kid on the block. Unlike in the electrified automotive market, it is difficult for EV powertrain component makers for the off-highway market to achieve economies of scale, as electric off-highway vehicles are produced in comparatively small numbers and differ widely in design and application.

On-board charging facilities to be an area of competition for manufacturers

Off-highway equipment can require highly specialized powertrain design enabling functionality in hostile environments. So, what does the future hold in terms of component pricing? Let’s look at three key bits of kit: the battery, the inverter, and the motor.

Battery prices to decline by 7-10% per year

With any electric vehicle, it’s the price of the battery that determines whether it can compete in terms of total cost of ownership with an equivalent internal combustion vehicle. Overall, battery pack prices are falling, but batteries for large vehicles are still high-cost components. And battery prices for off-highway vehicles are substantially higher than in the automotive or on-highway commercial sectors. There are two reasons for this: the earlier mentioned difficulty in achieving economies of scale in such a small market, and the non-standard packaging or shape of batteries required for insertion into specialist machinery. Any non-standard product comes with a price.

But there is good news on battery pricing for off-highway equipment. Our latest research has found that the industry expects prices to decline at a rate of 7-10% per year out to 2030 as the already evident boom in the electric passenger car market drives down the cost of cells and demand for electric off-highway vehicles increases.

But there are steps manufacturers could take to further speed up adoption of their solutions. Designing vehicles to take battery packs that are already produced in high volumes by the automotive industry is an obvious one. Using second-life battery packs is another, potentially highly cost-effective solution.

The inverter: significant price drops for traction inverters of heavy machinery

The inverter, or variable frequency drive, has been described as ‘the unsung hero of the drive train’. There are two types of inverters on an off-highway vehicle, one for traction, the other for work functions. Traction inverters usually have the higher power-rating and heavy equipment such as bulldozers have the highest priced inverters, reflecting their high voltage and power requirements. These inverters can currently cost many thousands per unit, but their prices are continuing to drop significantly.

Inverters for light equipment such as forklifts currently sell for far less. Meanwhile, inverters for medium-sized machines (75-200 kW) rank between the two. All categories of inverters are predicted for price decreases as sales volumes of electric machinery increase, and again, vendors in the electrified off-highway market could well benefit from partnership with the automotive market, or even directly with major industrial inverter manufacturers, who are likely to be able to supply inverters at lower costs.

The motor: limited scope for further price reductions

There isn’t much scope for price reduction in the market for small electric motors (below 25 kW) for light equipment such as forklifts. Electric motors are arguably already ‘commoditized’ and are produced in such large volumes that further increases in scale are unlikely to bring price advantages. The cost of these motors may, in fact, increase. That’s because they are metal heavy, and we are already seeing price increases for metals such as copper.

But, over the forecast period, we anticipate an overall price-drop of 1-3%. Larger motors used in heavy equipment, such as big excavators, offer the most scope for price declines. That’s because there is some scope for economies of scale as sales of medium and large electric machinery increase. And, as with batteries and inverters, OEMs may realise that, rather than manufacture their own, they can source cheaper and better motors from the established experts who are producing highly capable motors at rock bottom prices.

Asia Pacific to dominate market

As the EMEA market loses dominance, the focus for electrification of off-highway vehicles will move east. As 2030 approaches, APAC is forecast to become the biggest regional market for electrified power components for off-highway vehicles, raising market share from its current 30% up to 50%, as EMEA sees its dominant market position of 2019/20 erode.

China will drive much of the growth in Asia, where there will be a significant proliferation of electrified forklift trucks servicing the burgeoning warehousing sector, as well as an anticipated significant increase in electrified solutions for other off-highway vehicles.

Forklift trucks will continue to lead on electrification, but other equipment is gaining share

Aside from a strong Northern European focus on sustainable equipment, Europe is not otherwise currently meaningfully driving the electrified off-highway market. Meanwhile, the market in South America is negligible, largely due to a lack of interest from local governments.

About the author

NBM&CW November 2021