Good Time Ahead for Equipment Financing Industry

However, these companies feel that the delays in land acquisition and environment clearances are the key issues which need to be resolved on priority basis if the government wanted this growth story to be continued. Maria R. interacted with the major equipment finance companies whose excerpts are presented here.

Srei BNP Paribas

With the planned investment of $1 trillion in next five year plan 2012-17, how do you see the construction equipment market in general and the size of equipment finance industry in particular in next few years?

Devendra Kumar Vyas, CEO, Srei BNP Paribas

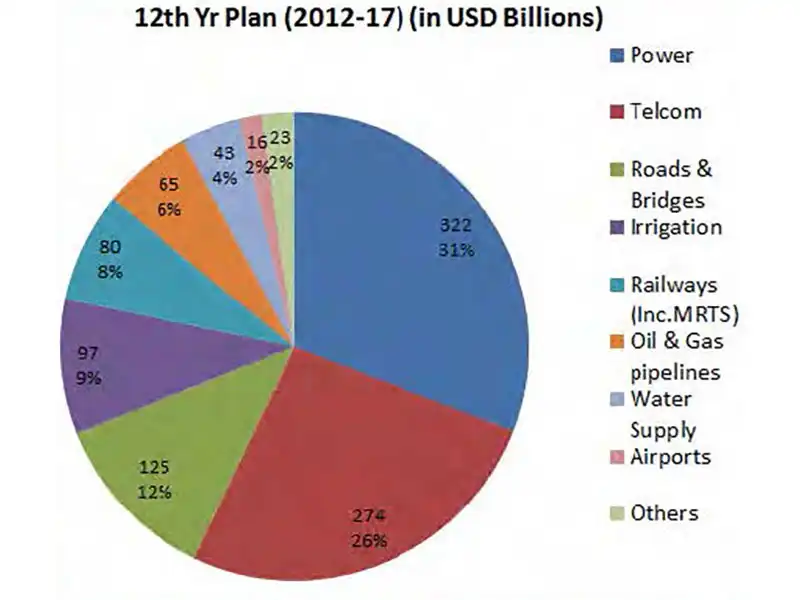

Devendra Kumar Vyas, CEO, Srei BNP ParibasThe Indian infrastructure & construction equipment (ICE) industry has experienced vibrant growth since 2003-04. According to KPMG estimates, the industry has registered a CAGR of about 18% since 2006, and is currently at about $3.3 billion, with volumes in the vicinity of 70,000 units per annum in the organised market. In the same report of KPMG, it has estimated that this would grow to about $20 billion by 2020.

The ICE market is bound to grow in the coming years, but from short-to med-term, there is likely to be some moderation in growth. A confluence of multiple macroeconomic problems, both at home and abroad, has created a situation where liquidity is scarce, cost of credit is high and a sense of policy paralysis has slowed down both project implementation as well as announcement of new projects. But these are temporary problems, we may have to be patient for a few quarters, but ultimately growth will happen.

Going forward, I foresee a huge demand for mining equipment. There is a growing mismatch of demand and supply of power in India, in fact we are staring at a power crisis. Coal fuelled power plants account for nearly 55% of India's total power generation capacity and coal also accounts for almost 80% of India's mining activities. At present, there is some policy confusion on allotment of coal blocks. But this will eventually get resolved and there will be an emphasis on use of state-of-the-art technology in order to scale up productivity.

Analysis of a typical Indian customer reveals that he is extremely price and value focused, because majority of these customers are small time entrepren- eurs scattered across the length and breadth of the country and provide services like construction, transportation, etc. in the infrastructure sector. Keeping this in mind, I feel leasing and rentals can be extremely beneficial to suit their needs. After all, leasing has proved to be the most potent and cost-effective form of capital creation worldwide. Also, keeping in mind the fast pace of technological progress and the shrinking utility life of machines (upgraded version of each machine makes the last one almost redundant) I feel equip- ment renting has huge potential, especially if a customer has to use any machine for a limited period. Used equipment also have tremend- ous potential. But the financing pen- etration for used machines is very small. There exists no proper tra- ding platform for used equipment.

Self-depreciating assets like ICE need to be acquired upon debt/lease and have to amortized over one or more projects depending upon the nature of equipment and the duration/cost of projects. Depending on the order book position of the contractor, he has to take a call on whether he would like to own the machine or lease it or even take it on rent for a specified duration. I feel going forward these trends will emerge and become more promin- ent as the users become more aware of the attendant benefits. Once a trading platform for used machines is in place, this sector will also become more organized.

Could you please elaborate on your various financing schemes, their advantages, and your business focused areas?

At any given moment, we have several schemes and programmes running with our manufacturer partners. We, at SREI BNP, have relationships with over 50 manufacturers based in India and abroad. Our schemes are tailor-made such as to suit a particular demand supply scenario, to cater to some season or festival, as capital purchases are considered auspicious in India. Our business focus areas remain construction and mining equipment, technology and healthcare, rural infrastructure and logistics.Why NBFC is more preferred option for financing vis-à-vis bank?

In infrastructure projects, the big developers usually sub-contract part of their work to the small and medium scale entrepreneurs who constitute the bottom of the infrastructure pyramid. However, these players do not enjoy access to institutional financing (like banks). Thus, it is the NBFCs which cater to the credit needs of such players. The NBFCs have grass-roots knowledge of the credit needs of these players and have a fair idea of their capability. NBFCs take a call on extending credit to these players based on the track record of these players, their order books, cash flow, etc. Credit intermediation has been the most preferred route for credit expansion and NBFCs have played this role for the past 30 odd years to near perfection. And NBFCs' decision-making process is also much faster vis-à-vis banks.Thus, NBFCs have a big role to play in rectifying the supply-demand imbalance at the bottom of the pyramid. RBI is also playing a constructive role by re-classifying the various categories of NBFCs so that all NBFCs do not operate under a blanket regulatory framework. This is the right approach by RBI to acknowledge the contribution of NBFCs like the Asset Finance Companies (AFCs) and the Infrastructure Finance Companies (IFCs) to the process of nation-building. However, NBFCs like AFCs and IFCs need a level playing field vis-à-vis banks in order to perform their duties better.

What is your company's edge over competitors?

We have been in this field for 23 years now and in ICE financing, we are the market leaders. Ever since, we forged a partnership with BNP Paribas, we have not only consolidated our leadership position but also started expanding out asset portfolio by expanding into verticals like IT and medical equipment. Our pan-India presence and in-depth knowledge of the Indian market, make us a preferred player for any equipment manufacturer (Indian or foreign) who is eyeing a share of the ICE market in India.In addition, building relationships (be it with our manufacturers partner or our customers) has been our forte and that works as a huge advantage. With small and medium enterprises being the majority of our customers and a large percentage of them being First Time Users (FTUs), we have to do a lot of hand-holding. We cannot restrict our role to just that of a financier, we take on the role of an asset manager. Our services span the enter value chain in infrastructure, and at SREI BNP, we cater to the entire value chain from Procurement to Disposal. SREI BNP acts as a guide to its retail clients by advising them on what kind of asset would be ideal for the projects that they have undertaken. The right advice in making the correct choice of assets and the ideal tenure of financing work wonders for most clients. SREI BNP's unique customer proposition has comprised acquisition, deployment and exit. With such rich guidance and service bouquet, our value proposition towards our customers is much beyond finance. This has, over the years, facilitated in building a strong customer loyalty which is reflected in that fact that 60% of our financing is to repeat customers. Today, we boast of a client base of over 30,000 customers and we have tied up with over 50 manufacturers for being financier of their equipment.

And of course, innovation has been the hallmark of Srei. We have pioneered several innovations in the field of ICE financing in India. Few of those schemes that we have offered or are still offering have already been mentioned before.

India has extremely complex tax system. What government supports and policy implementation are needed for the growth of equipment finance industry?

The ICE industry faces several challenges in terms of taxation issues as well as regulatory issues. Most heavy equipment are not registered and are without all-India permits. Inter-state movements of these equipment become a nightmare for operators. We anticipate that with the Introduction of GST, some of these may hindrances may come down.Putting in place a proper registration procedure for infrastructure equipment is key to an orderly growth of used equipment market as this can help in calculation of residual value of used equipment.

Prime life of each equipment is around 3-4 years. With rapid technol- ogical progress, the equipment life-cycle is progressively getting shorter. In this backdrop, a depreciation rate of only 15% p.a. for an equipment asset acts as a huge deterrent for a healthy growth of the industry. The depreciation rate should be increased to 30% p.a. at least.

In India, leasing suffers from an identity crisis. There is a clear lack of understanding about the benefits of leasing at our policy-making levels and here leasing is treated both as a 'good' and as a 'service' and taxed multiple times thereby reducing its efficacy and leading to low penetration in Indian markets.

In addition, with NBFCs being the principal vehicles for ICE financing in India, the challenges faced by the NBFCs also act as dampeners to the healthy growth of ICE industry in India. NBFCs do not enjoy a level playing field vis-à-vis banks and other financial institutions, especially when it comes to issues like making provisions for bad loans, while recovering assets once a loan goes bad or paying taxes on sticky advances. With the regulatory framework tilted heavily in favour of borrowers, this creates incentives for willful defaults. With most borrowers working in government / quasi-government projects, repossession of assets in case of defaults becomes even more challenging for NBFCs.

The only way forward to resolve this issue is to intensify the dialogue process with government authorities at various levels and make them realize that the faulty policies are costing India dear.

Magma Finance

With the planned investment of $1 trillion in next five years plan 2012-17, how do you see the construction equipment market growth in coming years?

Sunil Gupta, VP - CE Finance, Magma

Sunil Gupta, VP - CE Finance, MagmaThe Union Budget for FY 2012-13 also has given a lot of emphasis to Infrastructure sector. More stress has been given to enhance & develop Rural India. Setting up of Infra-investment fund of Rs.50,000 crores, Tax-free bonds for Rs.60,000 crores, allocation of Rs.25,360 cr for the Road Transport and Highways Ministry, ECB for capital expenditure on the maintenance etc. are good measures and will definitely help the sector. The likely growth drivers for the segment would be - Target of covering a length of 8,800 kilometre under NHDP and Delhi-Mumbai Industrial Corridor with investment of $90 billion.

If the government is able to mobilize the resources & funding for the planned investment, we may see huge growth in the construction equipment market.

However, delays in land acquisition and environmental clearances are leading to delays and increased interest costs for the sector. This is impacting large infra companies and their project viability. Policy issues like land acquisition, environmental clearances and mining need to be addressed on priority basis.

What is the size of equipment finance Industry in India and how do you see this segment evolving in next few years?

Could you please elaborate your various financing schemes, their advantages, and your business focused areas?

Magma Fincorp Limited was incorporated in 1988 and registered with the Reserve Bank of India as an asset financing NBFC. Magma is listed on National Stock Exchange and Bombay Stock Exchange. Magma today is one of the largest asset finance companies and carries an asset base of Rs.13,293 crore as on March 12. Magma has been one of the fastest growing asset financing companies in the country with a disbursement CAGR of over 26% in the past five years.Magma today has a pan India presence with over 200+ locations in 21 states and represented by a qualified team of over 5700 employees. Over 81% of our branches are located in rural and semi rural areas and about 60% of our customers are from the hinterlands. The deep rural and semi-urban presence further emphasises Magma's motto of providing equality of opportunity to the economically disenfranchised.

Magma offers individual and corporate customers a range of financial products and services in:

- Commercial Vehicle Finance

- Construction Equipment Finance

- Car and Utility Vehicle Finance

- Suvidha Loans (Refinance)

- Strategic Construction Equipment Finance

- Tractor Finance

- SME Loans

What is your company's edge over competitors?

Distribution & reach gives us tremendous edge. We have a pan India presence with over 190 locations in 21 states. We cover a distance of 200 Kms from our nearest location and provide doorstep services to the customers. Complete transparency of schemes, customer-friendly schemes & products is our other USP.Why NBFC is more preferred option for financing visà- vis-bank?

NBFCs offer faster turn-around-time, doorstep services, tailor made schemes to suit individual requirement, higher Loan to value, simple documentation process and various customer-friendly schemes. A combination of these services make the NBFCs leading players in the segment.India has extremely complex tax system. What government supports and policy implemen- tation are needed for the growth of equipment finance industry?

For the infra sector, land acquisition issues, environmental issues and policy paralysis are the key challenges today. A large number of infra companies into BOT projects are facing liquidity crisis arising out of delays and hurdles in land acquisition and environmental clearances leading to delays in financial closure of the projects. This in turn is having a ripple effect on the entire infra segment.Some of the government policies on Retro Tax Amendments and cancellation of Telecom Licence by supreme court have dented investor confidence in the Indian infra sector. The power sector is also facing severe crisis on account of challenges around coal linkages. Telcom, Power and Roads are the key sectors within infra & all these sectors are facing serious challenges today. The government has to take immediate steps to resolve all these key issues and restore investor confidence into the sector.

Tata Capital Financial Services Ltd.

With the planned investment of $1 trillion in the next 5 years plan 2012-17, how do you see the construction equipment market growing in the coming years?

Ranjit Manjarekar,(Head- Infrastructure Finance), Tata Capital Financial Services Ltd

Ranjit Manjarekar,(Head- Infrastructure Finance), Tata Capital Financial Services LtdWhat is the size of the CE finance industry in India and what is the share of your company?

The CEQ Finance industry has a market of approx 25,000 crores. The construction equipment industry is anticipating a growth of 15-20% in the next 5 years. Currently, we have 8-10% share in the industry and expect to grow at 15%.Could you please elaborate on your various financing schemes, their advantages, and your business focused areas?

We cater to all the needs of the retail and institutional customer -truly one-stop shop for investments or finance offering gamut of services as Inventory finance, monsoon schemes, bullet emi, repayments as per the cash flow & free insurance schemes.We finance an entire range of construction equipment from Excavators, loaders, backhoes, and large crushers. We also provide you the required equipment on monthly rental basis. The equipment are owned, operated and maintained by us, freeing you of the day to day operational worries. Moreover, you can utilize these machines for as long as you need them.

We have custom made products & schemes for retail customers, corporate and construction equipment dealers. We offer monsoon scheme, repayment as per cash flows, top-up loans, insurance for retail customers; inventory finance & infrastructure development for dealers and operating lease & equipment on rentals for corporate clients.

What is your company's edge over competitors?

Our unique financial products, faster turnaround time, competitive rates, flexible repayments, preferred financier by all leading OEM's sets us apart. We provide various financial products for the entire supply chain of Infrastructure Finance e.g., Equipment finance, Dealer Inventory & Infra Finance, Project Finance, Bill Discounting, Vendor Finance etc. A team of 250+ trained resources, presence in more than 90 locations and customer connect makes us what we are. Needless to mention the support extended by leading OEMs has been a key contributor in our success.Why NBFC is more preferred option for financing vis-à- vis bank?

NBFCs have been preferred by customers due to their reach, services and structured product offerings. With RBI's decision to launch infra NBFCs, the NBFC's stand against banks have some strengths, however there is still a lot to come from the government in terms of NBFC support.

NBM&CW August 2012